If you have a big amount of out-of-pocket medical bills, you might wish to itemize and deduct them. You Are allowed to deduct the portion of your medical and dental expenses above 7.5% of your AGI. See the Directions for Schedule A (Form 1040) to determine what limitations apply. You can also refer to Publication 501, Dependents, Normal Deduction, and Submitting Information.

- Keep In Mind, the most important a part of taking deductions is keeping your receipts.

- My accountant was impressed with the format and stated it saved her a lot of time on my tax return.

- Charitable contributions are a meaningful way to give back to your group and a useful opportunity to minimize back your taxable earnings.

- An investment is one thing that could probably be expected to produce income, such as dividends or interest, or something you count on to appreciate in worth so you’ll find a way to promote it at a profit later.

How Do Itemized Receipts Support Coverage Enforcement?

The passing of the Tax Cuts and Jobs Act (TCJA) in 2017 significantly altered what deductions have been available and confirmed above the SALT cap. The $10,000 restrict on deductions for state and local taxes may be a deciding factor for residents of high-tax states. If a married couple in the state cannot find the extra stability in eligible deductions on high of the $10,000, they will likely select the standard deduction. Consider evaluating state income and sales taxes to determine which provides the higher deduction. Optionally, the fee technique may additionally be famous, providing insight into whether or not the transaction was made via how to itemize receipts for taxes cash, corporate card, or credit card.

Medical and dental bills can characterize a important portion of your annual price range https://www.kelleysbookkeeping.com/, especially if you’ve had major health-related costs. Mark and Sara donate roughly $600 in money per year and another $300 price of used clothes and household items to a charity thrift retailer. We aim to ensure every thing on our site is up-to-date and correct as of the publishing date, but we can’t assure we have not missed one thing.

Claiming business bills helps decrease your tax burden, but the IRS requires some sort of documentation to verify the expense, the date of the transaction, and the way much it value. While receipts are the best document to keep, there are some eventualities in which you will be able to take tax deductions without them. While most business expenses require receipts to show the purchase in case of an IRS audit, there are some that you can claim with various documentation. This makes it easier to decrease your taxable earnings while putting minimal effort into your record maintaining.

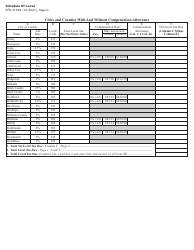

Client-billed bills – When passing costs to a client, an in depth breakdown ensures fairness and trust. Tax-deductible transactions – If you propose to say it in your taxes, you need proof of each item bought. The directions for Schedule A explain which of your bills are deductible and the place they want to be listed on the shape. If your annual mortgage interest (found on your Mortgage Curiosity Statement or Form 1098) is greater than the standard deduction, it’s advantageous to itemize deductions on Schedule A.

Earn 451% Curiosity On Your Savings!

To learn more concerning the uncommon exceptions, take a glance at Keeper’s guide to writing off grocery expenses. Keeper can observe your deductions throughout the year, so you may be all set to file with our submitting system when tax time comes around. And don’t fear, the app also makes it easy to deal with exceptions to your guidelines. These guidelines allow you to flag that transaction as a recurring business expense. Now, each time you make it appears, the app will categorize it as a write-off automatically. For instance, I’ve been utilizing a sure flight miles card once I have to journey for work.

Run Your Business With Confidence

You can deduct state and local income taxes, or you’ll be able to decide to deduct sales taxes if they are higher. This is especially helpful for residents in states with no revenue tax. For medical expenses to be deductible, they need to exceed 7.5% of your AGI. This consists of issues like doctor visits, surgical procedures, and even journey expenses related to medical care. Itemized receipts are essential for accurately tracking, justifying, and reporting employee spending. With Expense Tracker 365, you probably can automate the entire process from start to finish.

Ultimate Calculation/amount To Pay

To declare your itemized deductions, you’ll use Schedule A (Form 1040) to list and calculate your eligible bills. It’s an important tool for companies to precisely document and handle firm bills. Itemizing offers flexibility in the types of expenses you can deduct. This can be particularly advantageous for people who incur a wide selection of deductible costs, corresponding to business-related expenses or investment-related deductions. By keeping detailed records, you’ll have the ability to ensure that all eligible bills are accounted for and deducted.