Another bookkeeping franchise, Padgett Business Services, offers comprehensive training and support to their franchisees, helping them build successful bookkeeping businesses. They provide a wide range of services to their clients, including bookkeeping, accounting, payroll, and tax planning. They also offer financial statements, accounts payable, and other financial services to help businesses stay on top of their finances. A single-unit franchise is a stand-alone business that operates independently under the franchisor’s brand name and business model. In this model, the franchisee is responsible for all financial transactions, including bookkeeping, payroll, and taxes. The franchisor provides training and support, but the accounting process is entirely managed by the franchisee.

Look for a Successful Business Model

As mentioned earlier, some accountants have specific knowledge and expertise in franchise accounting, so they can ensure that you get your business started on the right foot. What’s more, you can even hire accountants who have experience with your brand in particular, which can prove invaluable. A CPA can do things an accountant can’t, such as send your tax returns to the IRS. Understanding CPA compensation and benefits can help you decide whether hiring a CPA is the right option. As a franchisee, they are an independent business owner, responsible for maintaining their books.

Key Bookkeeping Practices for Franchisees

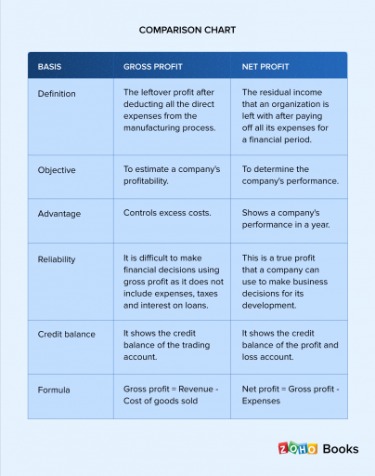

To ensure business success, it’s essential to conduct regular financial net sales: main differences with gross sales analysis and reporting. This involves evaluating financial data to identify trends, performance, and areas for improvement. Regular reporting helps to evaluate business performance and track progress towards financial goals. It also provides transparency to investors and other stakeholders, which is essential for building trust and credibility.

- The demand for bookkeeping services is high, and many businesses struggle to keep up with their financial reporting.

- You only pay for the services you need, plus, you reduce payroll taxes and benefits costs.

- Compliance tools within the software system help with tracking and reporting on fees, royalties, and marketing expenses.

Shoeboxed stores receipts in a format accepted by the IRS, making tax preparation and audits smoother. Digitized receipts become part of a searchable database, enabling quick retrieval of specific documents when needed. Franchisers who don’t have a Gmail account can forward email receipts to their Shoeboxed account for automatic processing and categorization. The Shoeboxed Gmail plugin automatically detects and extracts receipts from your inbox and turns them into organized expense records.

About Shoeboxed!

Our list of the top bookkeeping franchises for 2023 includes reputable franchisors who have been working in the US market and beyond for years. They are looking for new franchise units in the coming year, making this a great time to invest in this growing industry. With the right franchise, aspiring entrepreneurs can receive training and support to help them build a successful bookkeeping business of their own. A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a particular time.

Franchise bookkeeping needs to follow the terms of the franchise agreement. This might involve following specific budgeting or cost allocation guidelines. Virtual bookkeeping offers cost-efficiency, accessibility, and access to specialized expertise. It allows you to focus on your core business while professionals manage your financials remotely.

Struggle to Retain and Attract Finance and Tax Talent is Peaking, EY Says

Financial reporting is the process of preparing and presenting financial information to stakeholders. This includes the income statement, balance sheet, and cash flow statement. Financial reporting is important for the franchise owner, as it provides a snapshot of the financial health of the business. Inventory management is the process of tracking and managing inventory levels. This is important for a franchise business, as excess inventory can tie up cash flow, while insufficient inventory can lead to lost sales. Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service.

However, you may not realize that the grass how to fill out a bank deposit slip really is greener on the other side with Remote Quality Bookkeeping. Start your free trial, and see why businesses trust Remote Quality Bookkeeping with their books. Get started today with nationally certified bookkeeping specialists and advisors. Open a dedicated business bank account for all transactions pertaining to your franchise.

This means access to expertise that you might not be able to afford in-house. Outsourcing providers also stay up-to-date on the latest industry trends, regulations, and software so you don’t have to pay for training. Software like QuickBooks and Xero offer solutions that work well in bookkeeping for franchisees. Up-to-date records give franchisees a picture of much money they are bringing in versus spending. This helps them understand their profitability and identify areas for improvement. Since royalties are typically paid as a percentage of sales, the 3.5 process costing franchisee must compute them after the fact.